By Gianluca Sampaolo[1] and Francesca Spigarelli[2]

Introduction

A semiconductor device is an electronic component that relies on the electronic properties of a semiconductor material (primarily silicon, germanium, and gallium arsenide, as well as organic semiconductors) for its function.[1] An integrated circuit or monolithic integrated circuit (also referred to as an IC, a chip, or a microchip) is a set of electronic circuits on one small flat piece (or “chip”) of semiconductor material. This global industry exceeds $500 billion, projected to reach $1 trillion by 2030,[2] and is crucial for technology sectors like AI, autonomous driving, and 5G,[3] as well as a large market for less advanced chips in industries such as automotive, healthcare, and manufacturing. The very same industry is today at the center of strong geostrategic interests and at the core of the global technological race for innovation capacity of states.

Recent shifts in global and geopolitical dynamics have led to a heightened recognition of technological leadership as a vital and central element of national security, prompting more proactive policy measures and interventions aligned with national strategic objectives, against the backdrop of a shift from multilateral to regional trade-investment agreements.[4] Geopolitical tensions, trade restrictions and the Covid-19 pandemic resulted in disruption and highlighted the vulnerability of global semiconductor supply chains, ultimately underscoring the need for resilient and diversified supply chains, domestic production capacity and innovation. A case in point is the current “Chip War” between the US and China.[5] Amongst others, this has exposed deep-seated structural deficiencies in the European Union (EU) semiconductors supply chain that have been tackled by a recent industrial policy initiative with the objective of making the Union more resilient and self-sufficient to a greater extent in the production and supply of semiconductors.

Despite decades of strategic initiatives and targeted investments in the pursuit of semiconductor technology independence, a critical void remains in the form of significant technological challenges in producing competitive high-end semiconductors devices, limitations in expertise, equipment, and technological capabilities faced by Chinese companies. In this context, it is intriguing to understand whether the industrial policies efforts pursued by the US first and then by the EU will, on the one hand, succeed in slowing down China’s technological advancement and, on the other hand, in building more regional and independent value chains.

China’s policy path for technological supremacy

Although China has yet to cultivate any world leading semiconductor companies, it has established presence in almost every step of chipmaking, thanks to decades of investment and development.[6] As reported by Li,[7] this journey began with the “March towards Science” in 1956 and gained momentum with the “Opening-up and Reform Policy” in 1978. Notable milestones include the formation of the “State Council Lead Group for the Promotion of Electronics Industry” in 1984 and the introduction of “Several Policies to Encourage Software and Integrated Circuits Industry Development” in 2000. The emergence of the Semiconductor Manufacturing International Corporation (SMIC) in 2004 marked a significant leap in technological sophistication. In 2006, the Chinese government officially embraced “indigenous innovation” as a national strategy with the issuance of the “Outline of the National Medium- and Long-term Programme on Science and Technology Development (2006–2020).” Subsequent initiatives, such as the “Guidelines to Promote National Integrated Circuit Industry” in 2014 and the establishment of the National IC Industry Investment Fund, further underscore China’s commitment to advancing its semiconductor industry. These efforts culminated in both the 2015 national strategic plan and state-led industrial policy Made in China 2025 and the 2020 Policies to promote high-quality growth in IC and software industries, aiming at making China dominant in global high-tech manufacturing, with a strong emphasis on ICs.[8] A strategic look at the supply chain shows that China’s semiconductor industry is resilient even under US pressure, despite significant weaknesses.[9] There are numerous weak links in China’s domestic semiconductor supply chain, particularly in supporting industries such as IC manufacturing equipment, materials, and Electronic Design Automation (EDA) tools. Chinese companies are hampered by several technological bottlenecks, making it challenging to produce competitive high-end semiconductors domestically. They lack the expertise and equipment to master the sophisticated process of fabricating advanced chips.[10] Even China’s most advanced semiconductor companies are much smaller and technologically lagging compared to international leaders.[11] .

As a consequence, although China has become the world’s largest electronics producer, the country remains heavily reliant on foreign companies to supply this critical technology. Since 2006, the import of semiconductors, including ICs and other types of silicon devices, has surpassed crude oil to become China’s largest imported commodity. By 2018, China’s annual import value for ICs had reached 300 billion US dollars, highlighting the country’s dependence on foreign technology.[12] As tensions with the US increase, it is only logical to assume that China would have doubled down on a path of indigenous development to supply crucial technology highlighting the importance of increasing domestic production capacity and reducing dependence on foreign sources. Such strategic necessity gained wider resonance in the political discourse of President Xi Jinping and the Chinese Communist Party’s technocrats. Indeed, on one side, this is demonstrated in China’s 14th Five-Year Plan (FYP), which incorporates the aforementioned policies into the objective of kējì zìlì zìqiáng (科技自立自强), which means “science and technology self-reliance and self-improvement”,[13] and which is further embedded in the broader political and economic agenda of the dual circulation strategy.[14] On the other hand, the Law on Science and Technology Progress of the PRC aims to develop and strengthen those areas identified as priorities in the 14th FYP, such as AI, Quantum Technology, IC, neural networks, genomics, biotechnology, and health sciences.[15]

The US strategy: from chokepoint measures to comprehensive innovation initiatives

The US government’s strategic imposition of restrictions on China’s access to advanced semiconductor technology, as observed in the hi-tech cold war,[16] has evolved from initial measures under the Trump administration in 2016 to a more assertive policy by the current Biden Administration, particularly in addressing national security concerns[17] The “National Defense Authorization Act for Fiscal Year 2021” (“the 2021 NDAA”) established the “CHIPS program” for semiconductor manufacturing and R&D, further fortified by the “CHIPS Act of 2022”, which allocated $50 billion to the U.S. Department of Commerce.[18] Of this, $11 billion is designated for R&D, leading to the establishment of the National Semiconductor Technology Center (NSTC) as a public-private consortium, functioning as an innovation hub for research, prototyping, and the development of new industries based on advanced chip capabilities.[19] Additionally, the CHIPS program includes the National Advanced Packaging Manufacturing Program (NAPMP), overseen by the director of the National Institute of Standards and Technology (NIST), responsible for establishing Manufacturing USA institutes to advance semiconductor manufacturing technologies and conduct R&D programs.[20]

Strategic imperatives and policy responses in the EU

The EU confronts distinct challenges in the dynamic realm of global digital technology, particularly in micro-electronics and cloud computing.[21] A reliance on foreign suppliers for chip design and manufacturing underscores critical structural deficiencies in the EU’s semiconductors supply chain.[22] Paramount to the EU’s trajectory is the imperative to establish a resilient semiconductors ecosystem, central to the digital and green transition and aligning with broader EU Policy Priorities.[23] The European Economic and Security Strategy (EESS) advocates for dedicated efforts, as exemplified by the European Chips Act (ECA), to bolster chip security and development.[24] This comprehensive strategy emphasizes economic security, de-risking, and investments in green and digital transitions. Essential to the de-risking endeavor is a meticulous risk analysis, acknowledging the inherent tensions between economic security imperatives and the imperative to uphold an open economy. As a matter of fact, the EU navigates a nuanced stance towards China, balancing partnership, competition, and systemic rivalry while maintaining a steadfast transatlantic alliance with the US. The ECA additionally underscores the importance of international cooperation with third countries to fortify the Union’s standing in the global semiconductor ecosystem.

Complex interdependencies in the global semiconductors value chain

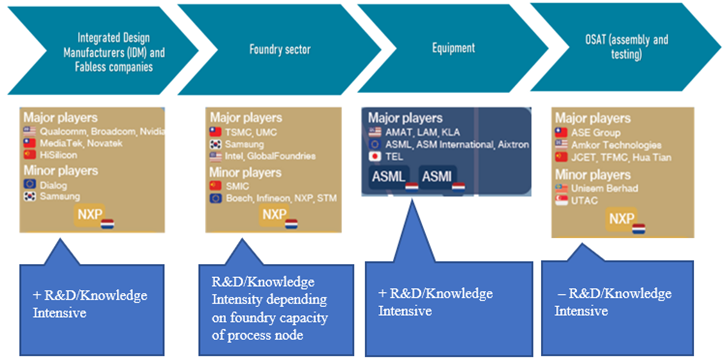

In the context of developing industrial policies aimed at technological autonomy, the reality is that the value chain remains highly complex, characterized by robust interdependencies and distinctly varied roles among the US, China, and the EU. A comprehensive analysis of the global semiconductor industry reveals its status as one of the most globally integrated sectors. Additionally, it stands out for its considerable strategic significance, featuring a notably unbalanced geography within its global value chain. The essential intellectual property linked to semiconductor design is concentrated in the United States, South Korea, Taiwan, and certain European locations. Meanwhile, a significant portion of production, assembly, and testing occurs predominantly in Asia, with China and Taiwan playing a particularly prominent role in these phases.[25]

Figure 1: The global semiconductor supply chain.

Source: Authors’ elaboration from Teer & Bertolini 2022.

Future research studies are essential to examine the extent to which various countries are genuinely capable of assuming a leading role or strong strategic positions concerning technological independence. From initial analyses conducted by the authors on import and export flows[26], a profound interdependence of the value chain emerges, along with a central position of China in exchanges across various geographical areas. Further research is crucial to elucidate the concrete prospects of developing a less globalized industry.

Conclusion

The events of the past year have created opportunities as well as heightened dangers. Russia’s attempts to use energy as a weapon have underlined the threat to the US and other countries of excessive dependence on potentially hostile foreign powers for critical manufactured products and materials. The US export controls designed to freeze-in-place China’s leading-edge chip development are a powerful brake on Beijing’s ambitions to become self-sufficient in foundational technologies. The US goal, ultimately, is to prevent the Chinese rise in semiconductors from being as preponderant as that which has occurred in other technology sectors as well as achieving a balance of the semiconductor production for Western allies by restructuring some critical supply chains away from China.[27] These dynamics suggest a selective deglobalization with strong connections to friendly countries and weaker ones with politically distant ones.

This evolving landscape of the global semiconductor industry underscores the burgeoning capacity being built by China in markets reliant on mature process nodes.[28] Should the US and its allies attempt to outpace China in establishing manufacturing capacity for mature process nodes, it would necessitate substantial time, resources, and a willingness to tolerate potentially higher prices. Moreover, China may explore the development and diversification of its value chain, particularly amid regional trade-investment agreements.[29] Concurrently, the effectiveness of the US “Chips Act” in bolstering the techno-industrial structure and sustaining technological supremacy remains a focal point for assessment. For Europe, the next decade presents a pivotal yet intricate opportunity to cultivate its semiconductor ecosystem and expand its global market share. The strategic objective, however, is not self-sufficiency, acknowledging the enduring strength of interdependencies in the supply chain. Instead, the emphasis is on an EU semiconductor ecosystem that is open to international collaborations for R&D inputs while being shock-resilient against geopolitical tensions, global crises, and market volatility. Navigating this complex geopolitical terrain involves addressing emerging U.S. export controls, signaling a policy of “technological containment” that compels Europe to grapple with the implications of defining China as both a “strategic competitor” and a “systemic rival.”

References

Baldwin, Richard, and Simon Evenett. COVID-19 and Trade Policy: Why Turning Inward Won’t Work, 2020. https://cepr.org/publications/books-and-reports/covid-19-and-trade-policy-why-turning-inward-wont-work.

Bown, Chad P, and Melina Kolb. “Trump’s Trade War Timeline: An Up-to-Date Guide.” Trade and Investment Policy Watch (blog), April 19, 2018. https://www.piie.com/blogs/trade-and-investment-policy-watch/trumps-trade-war-timeline-date-guide.

Ciani, Andrea, and Michela Nardo. “The Position of the EU in the Semiconductor Value Chain: Evidence on Trade, Foreign Acquisitions, and Ownership,” April 5, 2022. https://joint-research-centre.ec.europa.eu/publications/position-eu-semiconductor-value-chain-evidence-trade-foreign-acquisitions-and-ownership_en.

EU Commission. COMMISSION STAFF WORKING DOCUMENT Strategic dependencies and capacities Accompanying the Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Updating the 2020 New Industrial Strategy: Building a stronger Single Market for Europe’s recovery (2021). https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021SC0352.

EU Commission. COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS The European Green Deal (2019). https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2019%3A640%3AFIN.

EU Commission. JOINT COMMUNICATION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL AND THE COUNCIL ON “EUROPEAN ECONOMIC SECURITY STRATEGY” (2023). https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52023JC0020.

EU Commission. Proposal for a DECISION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the 2030 Policy Programme “Path to the Digital Decade” (2021). https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0574.

EU Commission. Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing a framework of measures for strengthening Europe’s semiconductor ecosystem (Chips Act) (2022). https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52022PC0046.

Grimes, Seamus, and Debin Du. “China’s Emerging Role in the Global Semiconductor Value Chain.” Telecommunications Policy 46, no. 2 (March 2022): 101959. https://doi.org/10.1016/j.telpol.2020.101959.

Grundmann, Marius. The Physics of Semiconductors. Springer Berlin Heidelberg, 2006. https://doi.org/10.1007/3-540-34661-9.

Holmes-Siedle, Andrew. “Semiconductor Devices.” Nature 272, no. 5648 (March 1978): 108–108. https://doi.org/10.1038/272108b0.

Hu, Qili, and Lichen Xinlu. 909 Chaoda Guimo Jicheng Dianlu Gongcheng Jishi (Road to Chips: Records from Ultra Large Scale Integrated Circuit Project 909). Beijing: Electronics Industry Press, 2006.

Kimura, Fukunari, Shujiro Urata, Shandre Thangavelu, and Dionisius Narjoko. “Dynamism of East Asia and RCEP: The Framework for Regional Integration.” Economic Research Institute for ASEAN and East Asia - ERIA, November 2, 2022. http://www.eria.org/publications/dynamism-of-east-asia-and-rcep-the-framework-for-regional-integration/.

Kleinhans, Jan-Peter, Reva Goujon, Julia Hess, and Lauren Dudley. “Running on Ice: China’s Chipmakers in a Post-October 7 World.” Rhodium Group China Corporate Advisory, March 31, 2023. https://rhg.com/research/running-on-ice/.

Kreher, K. “Fundamentals of Semiconductors – Physics and Materials Properties.” Zeitschrift Für Physikalische Chemie 198, no. 1–2 (February 1, 1997): 275–275. https://doi.org/10.1524/zpch.1997.198.Part_1_2.275.

Lazonick, William, and Yin Li. “China’s Path to Indigenous Innovation,” June 1, 2012.

Li, Yin. “State, Market, and Business Enterprise: Development of the Chinese Integrated Circuit Foundries.” In China as an Innovation Nation, edited by Yu Zhou, William Lazonick, and Yifei Sun, 0. Oxford University Press, 2016. https://doi.org/10.1093/acprof:oso/9780198753568.003.0007.

Li, Yin. “The Semiconductor Industry: A Strategic Look at China’s Supply Chain.” In The New Chinese Dream: Industrial Transition in the Post-Pandemic Era, edited by Francesca Spigarelli and John R. McIntyre, 121–36. Palgrave Studies of Internationalization in Emerging Markets. Cham: Springer International Publishing, 2021. https://doi.org/10.1007/978-3-030-69812-6_8.

Miller, Chris. Chip war: the fight for the world’s most critical technology. 1° edizione. London New York Sydney Toronto New Delhi: Simon & Schuster UK, 2022.

Orton, John. “Perspectives.” In The Story of Semiconductors, edited by John W. Orton, 19–46. Oxford University Press, 2008. https://doi.org/10.1093/acprof:oso/9780199559107.003.0001.

Purkayastha, Prabir. “US Chip Ban de Facto Declaration of War on China?” Asia Times, October 29, 2022. https://asiatimes.com/2022/10/us-chip-ban-de-facto-declaration-of-war-on-china/.

Sampaolo, Gianluca, Francesca Spigarelli, and Mattia Tassinari. (2022). La politica industriale in Cina: tendenze in corso e prospettive future. Rivista di Politica Economica 1, (2022). https://www.confindustria.it/home/centro-studi/rivista-di-politica-economica/dettaglio?doc=RPE_globalizzazione_industria_2022_1.

Spigarelli, Francesca, Gianluca Sampaolo, Mattia Tassinari, Vieri Calogero. (2022). “Chips Dominance: How Industrial Policies are Affecting the Global Production and Supply Chains” paper presented at the “Economic Statecraft and Industrial Policy” conference, September 21-22, 2023, Institute of East Asian Studies, Berkeley.

The State Council of the PRC. “中华人民共和国国民经济和社会发展第十四个五年规划和2035年远景目标纲要_滚动新闻_中国政府网 (Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035),” March 13, 2021. http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm.

The Standing Commitee of the NPC. “中华人民共和国科学技术进步法_中国人大网 (Law of the People’s Republic of China on Progress of Science and Technology),” December 24, 2021. http://www.npc.gov.cn/npc/c30834/202112/1f4abe22e8ba49198acdf239889f822c.shtml.

The State Council of the PRC. “Notice of the State Council on Issuing ‘Made in China 2025,’” May 19, 2015. https://www.gov.cn/zhengce/content/2015-05/19/content_9784.htm.

The State Council of the PRC. “Promote the Integrated Circuit Industry and Software Industry in the New Era. Several Policies for High-Quality Development,” August 4, 2020. https://www.gov.cn/zhengce/content/2020-08/04/content_5532370.htm.

U.S. Dept. of Commerce (a). “A Strategy for the CHIPS for America Fund,” September 2, 2022. https://www.nist.gov/chips/implementation-strategy.

U.S. Dept. of Commerce (b). “The National Semiconductor Technology Center Update to the Community,” November 15, 2022. https://www.nist.gov/chips/national-semiconductor-technology-center-update-community.

U.S.-China Economic and Security Review Commission. “2022 Annual Report to Congress,” 2022.

[1] Holmes-Siedle, “Semiconductors Devices”; Kreher, “Fundamentals of Semiconductorss – Physics and Materials Properties”; Grundmann, The Physics of Semiconductorss; Orton, “Perspectives.”

[2] Purkayastha, “US Chip Ban de Facto Declaration of War on China?”

[3] Li, “The Semiconductors Industry.”

[4] Baldwin and Evenett, COVID-19 and Trade Policy; Kimura et al., “Dynamism of East Asia and RCEP.”

[5] Miller, Chip war.

[6] Hu and Xinlu, Road to Chips; Lazonick and Li, “China’s Path to Indigenous Innovation”; Li, “State, Market, and Business Enterprise”; Li, “The Semiconductors Industry.”

[7] Li, “The Semiconductors Industry.”

[8] The State Council of the PRC, “Notice of the State Council on Issuing ‘Made in China 2025’”; The State Council of the PRC, “Promote the Integrated Circuit Industry and Software Industry in the New Era. Several Policies for High-Quality Development.”

[9] Li, “The Semiconductors Industry.”

[10] Grimes and Du, “China’s Emerging Role in the Global Semiconductors Value Chain.”

[11] Li, “The Semiconductors Industry.”

[12] Li.

[13] State Council of the PRC, “中华人民共和国国民经济和社会发展第十四个五年规划和2035年远景目标纲要_滚动新闻_中国政府网 (Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035).”

[14] Sampaolo et al., “La politica industriale della Cina: tendenze in corso e prospettive future.”

[15] The Standing Commitee of the NPC, “中华人民共和国科学技术进步法_中国人大网 (Law of the People’s Republic of China on Progress of Science and Technology).”

[16] Li, “The Semiconductors Industry.”

[17] Bown and Kolb, “Trump’s Trade War Timeline: An Up-to-Date Guide.”

[18] U.S. Dept. of Commerce, “A Strategy for the CHIPS for America Fund.”

[19] U.S. Dept. of Commerce, “The National Semiconductors Technology Center Update to the Community.”

[20] U.S. Dept. of Commerce, “A Strategy for the CHIPS for America Fund.”

[21] EU Commission, COMMISSION STAFF WORKING DOCUMENT Strategic dependencies and capacities Accompanying the Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Updating the 2020 New Industrial Strategy: Building a stronger Single Market for Europe’s recovery.

[22] Ciani and Nardo, “The Position of the EU in the Semiconductors Value Chain.”

[23] EU Commission, COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS The European Green Deal; EU Commission, Proposal for a DECISION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the 2030 Policy Programme “Path to the Digital Decade.”

[24] EU Commission, JOINT COMMUNICATION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL AND THE COUNCIL ON “EUROPEAN ECONOMIC SECURITY STRATEGY”; EU Commission, Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing a framework of measures for strengthening Europe’s semiconductors ecosystem (Chips Act).

[25] Grimes and Du, “China’s Emerging Role in the Global Semiconductors Value Chain.”

[26] Spigarelli et al. “Chips Dominance: How Industrial Policies are Affecting the Global Production and Supply Chains” paper presented at the “Economic Statecraft and Industrial Policy” conference, September 21-22, 2023, Institute of East Asian Studies, Berkeley.

[27] U.S.-China Economic and Security Review Commission, “2022 Annual Report to Congress.”

[28] Kleinhans et al., “Running on Ice: China’s Chipmakers in a Post-October 7 World.”

[29] Kimura et al., “Dynamism of East Asia and RCEP.”

[1] China Center, University of Macerata,

[2] China Center, University of Macerata,