by Julien Vercueil, Centre de recherches Europes-Eurasie, National Institute for Oriental Languages and Civilizations, Paris

Sintesi

La nota discute lo status, la natura e il futuro delle economie emergenti, partendo dall’origine del concetto di emersione economica e dalla sua evoluzione storica. Il concetto di emersione è una nozione intrinsecamente dinamica. Si tratta di un processo di trasformazione economica e istituzionale dei paesi a medio reddito, che comporta un’accelerazione della crescita economica ed una maggiore partecipazione ai flussi di capitale e al commercio internazionali. Tale concetto può essere definito dalla combinazione di tre precisi criteri economici: livello di reddito intermedio; crescita economica; trasformazione istituzionale e apertura economica. Lo status di “economia emergente” non è tuttavia una condizione stabile. Alcuni paesi possono infatti evolversi e guadagnare lo status di “economia avanzata”, mentre altri possono essere soggetti ad una serie di vulnerabilità che vengono discusse nella nota.

Genealogy

« Emerging markets » is now a thirty-five years old expression. As other popular notions, its successive utilizations have carried transformations and slides of meaning that may have complicated its common understanding today. Therefore we think it could be useful to enlighten today’s discussions about the status, nature and future of “emerging markets and emerging economies” by recalling the genealogy of the concept and the recent history of its meaning. Hence we will be able to justify our own use of the concept, in order to characterize its current scope.

The first definition of ”emerging markets” was given by Antoine Van Agtmaël. Together with Vihang Errunza, he conducted a statistical comparative study of the financial markets of several developing countries during the 1975-1979 period. In their words, “emerging markets” designed a group of financial markets that, given their middle and long term perspectives in terms of return on investment, should attract major capital inflows from western investors

Why this expression of “emerging markets”? Simply because it evokes progress, growth and dynamism, and could please bankers and financial institutions more than “third world equity markets” (Van Agtmaël, 2007). Obviously, such a wording was not principally a matter of scientific analysis: it was first and foremost a branding manoeuvre. Besides, the creation of an “IFC Emerging Market Index” shortly followed this study, as well as an “Emerging Markets Growth Fund” created by Capital Investment, Inc., and many others later.

Starting from this financial birthplace, the notion of “emerging markets” was completed several years later by another one: “emerging market economy”. This notion aims at answering usual questions asked by investors about the macro-fundamentals of the countries in which they are investing. Indeed, in theory, in any country financial markets cannot perform dynamically in the long run without being supported by robust macroeconomic growth and other healthy macroeconomic records. From there, the “emerging economy” notion derived, progressively delineated by official publications from the World Bank, IMF, OECD, and the academy (Burki, 1999).

Unfortunately, these attempts did not help much clarifying this fuzzy concept. For instance, the IMF World Economic Outlook repeatedly used the notion of “emerging Asia”, or “emerging Europe”, to qualify some countries of these continents. But Africa and Latin America apparently did not deserve this qualification. Neither were Georgia and CIS countries included in the “emerging Europe”. In one IMF publication certain Asian countries are sometimes qualified of “emerging countries” (IMF, 2010, p. 64), sometimes not (Id., p. 67).

Last but not least, the notion of emerging economy has been completed by a range of acronyms that did not help, in turn, to clarify the economic meaning of the whole. BRICS, Frontier, N-11, CIVETS, CEMENT, BRIICS, NEST, MINT, Eagles, BENIVM, CARB are some examples of those acronyms that flourished in the financial community since the tremendous success of the initial “BRIC” expression used by Jim O’Neil, of Goldman Sachs, in 2001 in order to characterize four economic powers emerging out of the G-7 circle, in the beginning of this century (O’Neil, 2001).

Definition

The fact that the notion of “emerging economy” has not been clarified at an official level is understandable. In order to create a new official category of countries, the number of justifications that an international organisation like the World Bank and the IMF would have to provide has certainly been seen as problematic. Does it follow that any attempt to rationalize this category is doomed to fail? Would it be preferable to let aside this concept, because of its lack of consistency, and go on using old official categories as “middle income” economies?

Our hypothesis is that the phenomenon involved in the various meanings of the concept of “emerging economies” deserves attention, especially from economists who are aware of the importance of institutions in the process of economic and social development. While being diverse, emerging economies have some characteristics in common. They have been experiencing deep transformations for several decades that are far from being identical, but that are pointing toward the same direction: all of these countries have undergone major changes in their economic institutions since the 1990’s, and all of them are now much more integrated in the world economy than twenty years ago. They have become actors of the globalization, they have contributed to it in an increasingly large extent, and in return their economies have been profoundly shaped by it.

Economic emergence is intrinsically a dynamic notion. It is a process of economic and institutional transformation of middle-income countries that entails an acceleration of their economic growth and an increased participation to international trade and capital flows. It can be qualified by the combination of three criteria:

- First criterion: intermediate income. Per capita GDP, measured in PPP terms, is comprised between 10% and 75% of the average income in the European Union (obviously, those two limits are to be interpreted with a margin of flexibility).

- Second criterion: economic growth and catching-up process. During the past decades, these countries have enjoyed an average economic growth that surpasses European Union’s growth.

- Third criterion: institutional transformations and economic opening. The countries belonging to the “emerging” category can also be characterized by the recent changes in their institutional framework concerning economic activities, particularly as far as external economic relations are concerned. Therefore, their economic growth is now far more heavily influenced by external developments than before.

In the beginning of the 2010’s, we used this set of criteria to propose a indicative list of countries* that could be considered as “emerging economies” (Vercueil, 2011).

Evolution

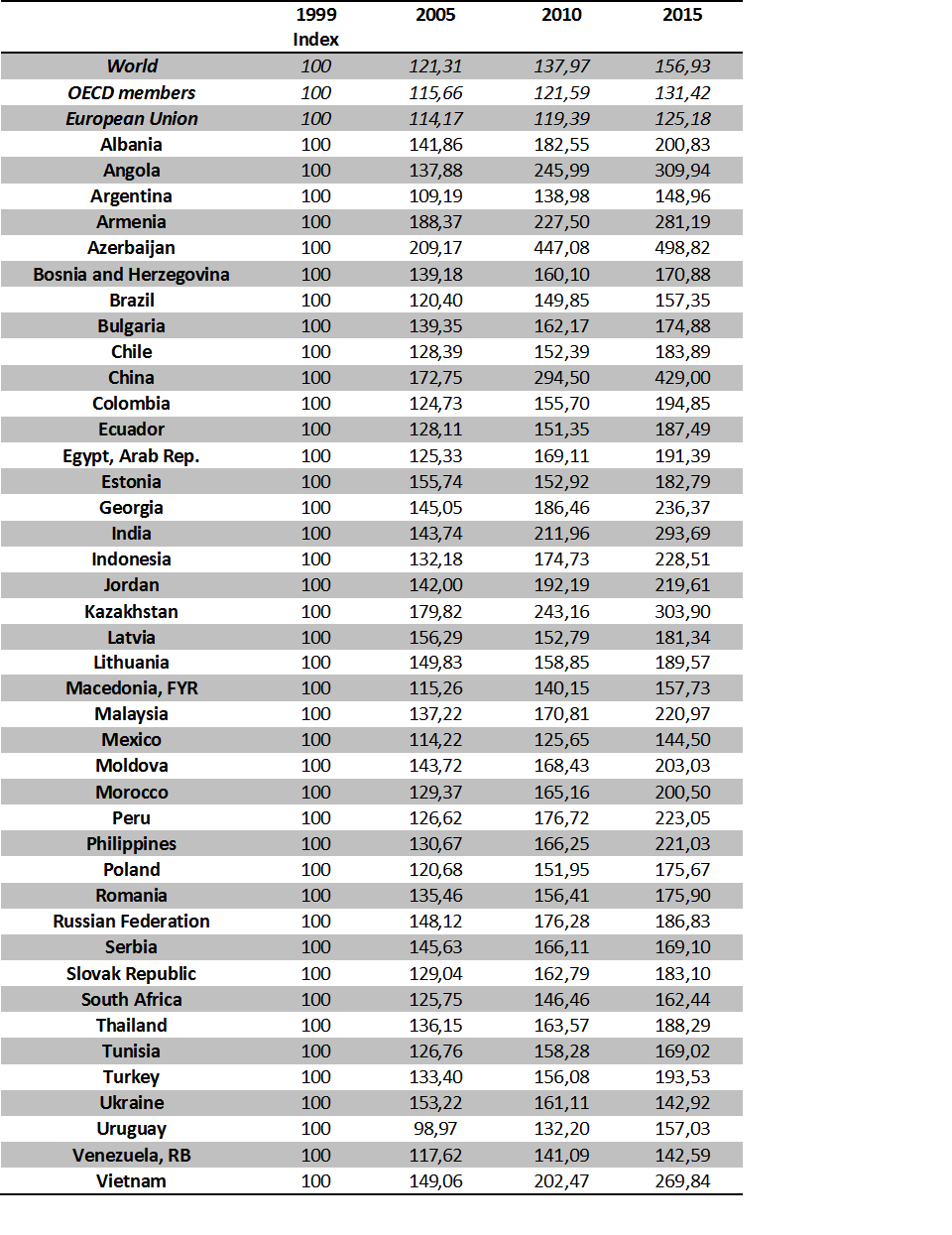

Five years later, has the meaning – and, eventually, the list – of emerging economies changed? The 2008 financial crisis and the following slowing down of the world economy have unevenly impacted these countries, depending on their growth model and their vulnerabilities (Vercueil, 2015). But all of the countries in our initial pool of “emerging economies” are still, in 2016 situated on a long-term catching up trajectory vis-à-vis more advanced (EU average or OECD average) countries (Table 1). Therefore, we claim that even in the current atmosphere of doubt about the current economic perspectives of some of them, it is simply to early to speak of the “end of emerging economies”.

Table 1. Cumulative GDP growth in selected emerging countries (1999-2015)

Source: The World Bank, 2016. Author’s calculations.

However, if we use a narrower time scope, we must reckon that several “emerging countries” have struggled against deep economic turbulences since 2008. For the past five years Latvia, Ukraine, Serbia, Venezuela and Russia have been showing economic trajectories that are less dynamic than the European Union, disrupting, for the moment, their long-term catching up trend. For the first four of them, their level of GDP is now even lower than it was in 2008. Meanwhile, by contrast, Argentina, Brazil and South Africa, who are also experiencing various degrees of economic and social difficulties nowadays, are still far better off in 2016 (between 11 and 13 % respectively) than they were just before the international financial crisis.

Vulnerabilities

This is not to say that the “emerging economies” category is a stable one. First, some countries can leave this category by becoming advanced countries. This is the case, for instance, of the Slovak Republic, whose per capita GDP in PPP terms is now significantly higher than 75 % of the average EU per capita income. Conversely, it is also possible that some institutional, political or economical changes in the situation of a given country (more probably if it is situated at the lower limit) prevent it to meet simultaneously the three criteria proposed before for defining an emerging economy.

Here come the vulnerabilities. Financial – overexposure to capital inflows and outflows for instance, or over-evaluation of the national currency -, economical – dependency on raw materials exports, structural deficit of the current account -, institutional – pervasive corruption, lack of proper regulation of a given sector, weaknesses in the rule of law –, social – income and wealth inequalities, socio-political conflicts in the society-, environmental – degradation of the living and working conditions for workers and their families, due to various pollutions, exhaustion of some raw materials -, and geopolitical vulnerabilities – unresolved territorial conflicts, political unrest of social groups that are fostered by a foreign country –, all these risks are present, to a certain extent, in each region where emerging economies are located.

Obviously, the political leadership’s ability to tackle each of these vulnerabilities without jeopardising their growth potential will be key for the future of these emerging economies.

References

Burki S. J., 1999. Changing Perceptions and Altered Reality: Emerging Economies in the 1990s. Washington, D.C. : The World Bank, 1999.

Van Agtmaël A., 2007. The Emerging Markets Century. New-York, N.Y.: Free Press, 2007.

IMF, 2010. World Economic Outlook. Washington, D.C.: IMF, October 2010.

O’Neil J., 2001. “Building Better Global Economic BRICs”, Goldman Sachs Global Economic Papers, n°66, 30 November 2001.

Vercueil J., 2011. Les pays émergents. Brésil – Russie – Inde – Chine… Mutations économiques et nouveaux défis. Paris : Bréal (2ème édition), 2011.

Vercueil J., 2015. Les pays émergents. Brésil – Russie – Inde – Chine… Mutations économiques, crises et nouveaux défis. Paris : Bréal (4ème édition), 2015.

Notes

* See Table 1. Some countries are absent of this list due to a lack of data in 2011 in the Groeningen University database used for its elaboration: Algeria, Costa Rica, Dominican Republic, Guatemala, Honduras, Jamaica, Lebanon, Libya, Panama, El Salvador.