By Annalisa Prizzon[*]

Governments are trying to reallocate resources to health care and plan expansionary fiscal policies to kick-start economic recovery in the face of the Covid-19 crisis. However, funding has dried up, the tax base has shrunk and the demand for exports has plummeted in many countries because of trade and travel restrictions. As economies are designing their recovery packages, many are very likely to seek additional external assistance because other financing options are simply no longer available or at least not at the scale needed.

While other sources decline and fiscal needs expand, development aid is one of the few financing options that remain for many countries as it is less pro-cyclical than other development finance flows (ODI et al., 2015). It is in the interest of all countries to support emergency and recovery efforts against Covid-19 as well as the provision of vaccines.

Aid during the 2008–09 global financial crisis

There are concerns about falling aid volumes presently but – as in previous crises – there are early signs that a few donors are keeping their commitments. As the 2008–09 global financial crisis unfolded, discussions arose about how this event would impact developing countries, including the effect on aid supplies. In November 2008 the Organisation for Economic Cooperation and Development (OECD, 2008) urged all member states to confirm their existing aid promises. The outcome document of the December 2008 Doha International Conference on Financing for Development stated ‘We are deeply concerned by the impact of the current financial crisis and global economic slowdown on the ability of developing countries to access the necessary financing for their development objectives’ (United Nations, 2009: 29).

While the OECD (2009a) reported that aid was at its highest level ever in 2008 and the G20 affirmed its pledge to increase financial resources to developing countries in April 2009, there was a lot of uncertainty around donor reactions and future aid budgets. Most early commentaries predicted large falls in official development assistance (ODA), while a few pointed to inconclusive evidence from previous crises (Cali et al., 2008; Roodman, 2008; CONCORD, 2009; OECD 2009b).

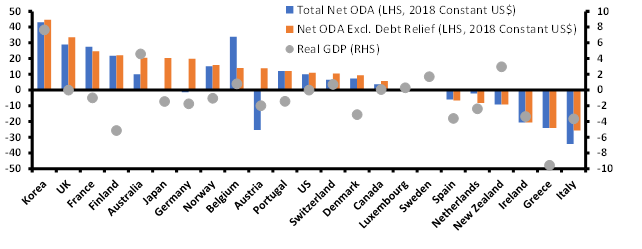

These forecasts proved wrong, all in all, as total aid flows still rose during the global financial crisis: between 2008 and 2010 they increased by 7.2% in real terms. Looking in closer detail, total aid flows rose by more than 10% over 2008–10 in several donor countries, including three of the largest ones – France, the United Kingdom (UK) and the United States (US). If debt relief is stripped out of the data, all five of the largest OECD Development Assistance Committee (DAC) donors at the time of the crisis – France, the UK, the US, Germany and Japan – recorded an increase in real disbursements of over 10% during this period. Figure 1 shows the change in real aid disbursements between 2008 and 2010 for a sample of 23 donors: aid disbursements rose even in countries experiencing economic recessions, including, to different extents, all the largest donor countries by volume.

Figure 1: Percentage change in gross domestic product (GDP) and net ODA disbursements, 2008–10

Source: Authors’ elaboration drawing on OECD (2020a and 2020b), based on Carson et al. (forthcoming). Note: Note: Ordered by change in net ODA excluding debt relief

Aid and the Covid-19 crisis

Similar concerns have surfaced now, but this time the crisis runs far deeper than in 2008. Commentators and international organisations have raised concerns about economic recovery from Covid-19 and there have been negative outlooks for aid flows both during the pandemic and for the aftermath (Arlington, 2020; Development Initiatives, 2020). However, the impact of the current crisis is estimated to run much deeper and be more widespread than the 2008-09 global financial crisis.

Based on International Monetary Fund (IMF) and OECD forecasts, GDP is expected to decrease by between 2.9% and 7.9% among the top-10 DAC members in the period 2019–2021, ranked by volume of their ODA disbursements. This compares with a fall in GDP at the time of the global financial crisis of 1.2%. A paper produced by Development Initiatives (2020) projects that constant price net ODA flows will fall by between 2.6% and 16.3% between the end of 2019 and the end of 2021. The Development Initiatives study assumes that countries will retain the same share of aid-to-gross national income (GNI) post-Covid as pre-Covid. The study uses two sets of forecasts – the OECD ‘single-hit’ (a more optimistic scenario when a second wave of the pandemic does not materialise in 2020 and 2021) and ‘double-hit’ scenarios (a more pessimistic scenario when a second wave materialises). Meanwhile, the ONE Campaign (2020) estimates that, in a worst-case scenario, net ODA flows could fall by 9.9% throughout 2020.

Commitments have already been made but transparency is lacking. Many bilateral and multilateral donors have made a series of announcements of new packages and commitments. Some donors have committed to comprehensive Covid-19 support packages outlining their response, while others have made piecemeal announcements focusing on immediate support to the World Health Organization’s (WHO) funding appeal. However, analysing the actual programmes and how resources have been distributed so far is a rather challenging task for many reasons: the rapidly unfolding events make them difficult to capture and, often as a result, there has been a lack of transparency in several donor commitments at least so far. Development partners have very different approaches to communications around the implementation of Covid-19 projects, which generally reflect their transparency overall and the standard practices of development agencies (Carson et al., forthcoming).

Several DAC members are striving to keep their commitments, at least so far. Among the top-10 bilateral donors, by volume, which report to the OECD DAC, Canada, Germany, the Netherlands and the US have all committed new ODA funding for the Covid-19 response; France, Sweden and Norway have maintained their existing budgets; the UK is the only donor to date that has announced budget cuts.[1] The Covid-19 crisis has made some projects (temporarily) unfeasible to implement, legitimising re-allocations within aid budgets. This was not the case in the previous crisis in 2008–09. Another difference is that the Covid-19 crisis has reduced expenditure for refugees/first-year asylum seekers, freeing up funding for other activities in the ODA budget (Carson et al., forthcoming).

Multilateral development banks (MDBs) have responded at scale but an expansion of lending and operations is needed. MDBs have provided a total of $223 billion for the Covid-19 response– with economic resilience, liquidity and trade facilitation as the main areas of intervention – far greater than bilateral donors (Miller et al., 2020; Carson et al., forthcoming). MDBs are re-allocating and front-loading resources; for example, the European Bank for Reconstruction and Development (EBRD) has dedicated its entire portfolio to the Covid-19 response. But the scale of the challenge ahead will require additional financial effort from shareholders. Over the next two years, this should include a new round of general capital increases for non-concessional lending (‘hard windows’) across the MDBs to further boost their lending capacity, as happened in the aftermath of the global financial crisis. Sufficient investments in recovery from the crisis will also require shareholders to support more generous replenishment rounds of the concessional finance windows (or ‘soft windows’) of MDBs and vertical funds (ibid.), i.e. development finance mechanisms targeting a specific purpose with mixed public-private funding (the Global Environment Facility or the Global Fund to Fight AIDS, Tuberculosis and Malaria are two examples).

The crisis prompted by the Covid-19 pandemic has accelerated an on-going transformation away from traditional aid models. Despite these turbulent times, there is potentially a positive outcome for the future of development assistance. The unprecedented systemic challenges posed by the Covid-19 crisis and the responses we have already seen will fast-track the transformation of an old paradigm of donor-recipient aid relations towards a model of international co-operation between all countries. This transformation, advocated by many commentators, was already underway pre-virus. Calleja and Prizzon (2019) have shown that countries moving up the income per capita ladder in Africa, Asia and the Pacific have seen their dependency on aid falling as their socio-economic indicators have improved. Government officials have repeatedly demanded other modalities of co-operation beyond financial transfers, such as knowledge sharing and peer learning. Countries want to learn how others have dealt with challenges and which solutions have worked. Development partners are also increasingly reflecting on how they should forge new relations with partner countries beyond traditional aid. During summer 2020, for example, the merger of the UK Department for International Development (DFID) into the Foreign and Commonwealth Office (FCO) – the Development Ministry into the Foreign Affairs Ministry in the UK – aims to forge an association between development aid and foreign policy that is closer than ever before.

Protecting or even expanding budgets for international development cooperation at times of crisis should be considered as an investment in global public goods, for a faster global recovery. Compared to advanced economies, many countries, especially in Africa and Asia, cannot either borrow in international capital markets at reasonable rates (because of their poor credit rating) or print currency (to avoid inflation spikes) or raise taxes (because of their low tax base and large informal economy) (Miller et al., 2020). It is in the national interest of all countries to support Covid-19 emergency and recovery efforts and the provision of global public goods such as vaccines via financial and technical international cooperation. The Covid-19 pandemic will be addressed only if it is addressed everywhere.

References

Arlington, L. (2020) ‘The aftershocks of OECD projections: impacts on Africa’. ONE blog, 12 June. London: ONE https://www.one.org/international/blog/oecd-projections-impacts-africa/

Cali, M., Massa, I. and te Velde, D.W. (2008) ‘The global financial crisis: financial flows to developing countries set to fall by one quarter’. London: Overseas Development Institute https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/3395.pdf

Calleja, R. and Prizzon, A. (2019), Moving away from aid: lessons from country studies, ODI Research Report. London: Overseas Development Institute.

Carson, L., Hebogård Schafer, M. and Prizzon, A. (forthcoming) Aid in times of crises: prospects for aid post-COVID 19. ODI Working Paper. London: Overseas Development Institute.

CONCORD (2009) AidWatch 2009: Lighten the load – In a time of crisis, European Aid has never been more important. Brussels: CONCORD AidWatch Initiative https://www.oxfam.org/en/research/lighten-load

Development Initiatives (2020) ‘Covid-19 and financing projections for developing countries’. Bristol: Development Initiatives undefined

Miller, M., Bastagli, F., Hart, T., Raga, S., Mustapha, S., Papadavid, P. et al. (2020) Financing the coronavirus response in sub-Saharan Africa. ODI Working Paper No. 579. London: Overseas Development Institute

https://devinit.org/resources/covid-19-and-financing-projections-developing-countries/

OECD – Organisation for Economic Cooperation and Development (2020a) ‘OECD creditor reporting system (CRS)’. Electronic dataset. Paris: OECD undefined

OECD (2020b) ‘OECD national accounts’. Electronic dataset. Paris: OECD http://www.oecd.org/sdd/na/

ODI et al. (2015), European Report on Development 2015 Combining finance and policies to implement a transformative post-2015 development agenda

OECD (2009a) ‘Development aid at its highest level ever in 2008’. OECD press release, 30 March https://www.oecd.org/dac/stats/developmentaidatitshighestleveleverin2008.htm

OECD (2009b) OECD Annual Report 2009. Paris: OECD

https://www.oecd-ilibrary.org/economics/oecd-annual-report-2009_annrep-2009-en

OECD (2008) ‘OECD calls for aid pledge from donor countries’. OECD news item, October 2008, Paris https://www.oecd.org/dac/oecdcallsforaidpledgefromdonorcountries.htm

Roodman, D. (2008) ‘History says financial crisis will suppress aid’. Washington, DC: Center For Global Development https://www.cgdev.org/blog/history-says-financial-crisis-will-suppress-aid

United Nations (2009) Doha declaration on financing for development: outcome Document of the follow-up international conference on financing for development to review the implementation of the Monterrey Consensus. New York: United Nations

https://www.un.org/esa/ffd/wp-content/uploads/2014/09/Doha_Declaration_FFD.pdf

[*] Senior Research Fellow, ODI

[1] The impacts on Italian and Japanese budgets are yet unknown.