By Roberto Roson[*]

Introduction

This paper presents an empirical exercise, aimed at investigating the implications on poverty and income distribution of a reference scenario (SSP2) of economic development. Shared Socioeconomic Pathways (SSPs) are scenarios of projected socioeconomic global changes up to 2100, by the International Institute for Applied Systems Analysis (IIASA). Under the SSP2 “Middle of the road” scenario, the world follows a path in which social, economic and technological trends do not shift markedly from historical patterns; income inequality persists or improves only slowly. It does so by coupling a dynamic general equilibrium model of the global economy, specifically designed to capture structural change dynamics in the medium and long run, with detailed micro data on household income in six countries: Albania, Bolivia, Ethiopia, Malawi, Nicaragua and Vietnam. It also considers an alternative scenario of accelerated international trade integration, with a higher degree of trade openness.

Related literature

There exists a vast literature, which has inquired, from different angles, the nexus between economic development, international trade and poverty (or income distribution). The key questions addressed in the field could be framed in terms of a triangle growth-trade-inequality. For instance: is growth conducive to more trade (or vice versa)? Does higher growth imply more inequality (or vice versa)? Is trade integration bringing about more (or less) inequality?

The main message is that the channels influencing the mutual interrelationships are many and complex (Winters, McCullock and McKay, 2004). Theory provides a strong presumption that trade liberalization will be poverty-alleviating in the long run and on average. At the same time, since trade liberalization tends to increase the opportunities for economic activity, it can very easily increase income inequality while at the same time reducing poverty. Even if trade could contribute to inequality within a country, however, the academic literature has concluded that trade is not the main driver. Nonetheless, adverse effects of import competition appear to be highly geographically concentrated and long-lasting, in developing and developed countries (Pavcnik, 2017).

One major issue in this literature is the possible ambiguity of concepts. When we talk about poverty, for example, are we (perhaps implicitly) referring to income per capita? Or, should we better consider the risk of getting unemployed, which is actually related to market instability (Santos-Paulino, 2012)? Should we focus on the individual or on the household? How to appropriately account for informal markets, self-employment and subsistence consumption?

In the same vein, the concept of higher trade integration is not without equivocalness. The conventional approach is framed in terms of lower trade frictions: tariff and non-tariff barriers, transport, communication and cost margins. As technological progress lowers mobility costs, on one hand, and international agreements lower tariffs and other normative barriers, on the other, the gross volume of international trade would grow over time proportionately more than global GDP (Brahmbhatt, 1998). However, Feenstra (1998) argues that falling tariffs and transportation costs “are only partial explanations, leaving three-fifths of the growth in trade relative to income unexplained” and that “when countries become more similar in size, they import more product varieties from each other”. This echoes the modern theory of trade, which stresses the role of economies of scale and product differentiation. The bottom line is that not only the volume of trade matters, but also its nature and composition.

A recent strand of literature has linked trade to knowledge spillovers and endogenous growth, suggesting that this mechanism could bring about trade benefits much larger than what suggested by the conventional theory (Hsu, Riezman, and Wang, 2019). This argument is relevant for income distribution, to the extent that heterogeneous workers sort themselves into different activities, in such a way that more trade produces effects similar to skill-based technological progress (Grossman and Helpman, 2018).

Modeling strategy

We base our exercise on the G-RDEM model for the construction of future scenarios and simulation of structural change (Britz and Roson, 2019). The G-RDEM model extends the standard GTAP model (Hertel and Tsigas, 1997), by adding some key drivers of long-run structural change, namely: (1) variations in household consumption patterns, giving raise to non-linear Engel curves; (2) differentiated sectoral productivity growth; (3) debt accumulation generated by trade imbalances; (4) variable saving rates, influenced by population and income dynamics; (5) time-varying and income dependent industrial input-output parameters.

The G-RDEM model, as the standard GTAP model, normally considers only one representative consumer in each country or region. Here, we instead exploit information from a set of household surveys (Food and Agriculture Organization, 2017), to get 12 distinct household categories, for the six countries considered. We distinguish among male and female headed households, urban and rural, poor (below the poverty level in 2011), middle income (between poverty and the mode of the income distribution), and rich (the rest). To model each household category, we need to define the various sources of income and the specific consumption pattern, in such a way that the data is consistent with aggregated consumption in the GTAP social accounting matrix.

Key findings

For the assumed baseline scenario SSP2, a data repository is maintained at the International Institute for Applied Systems Analysis (IIASA). From this source, we extract data about national or regional GDP and population, which are therefore taken here as given. Therefore, our G-RDEM model works as a sort of “multiplier of scenario variables”, in the sense that it generates a sequence of global general equilibrium states, consistent with information from SSP2, but including details at the level of industrial production, trade flows, consumption patterns, etc. Furthermore, because of the model extension with finer disaggregation for household classes, we can explore the consequences of the chosen scenario on income distribution.

Growth in real income per capita, over the whole 2011-2050 period, is posited at 134% for Albania, 309% for Bolivia, 480% for Ethiopia, 378% for Malawi, 377% for Nicaragua, and 413% for Vietnam. National population is not assumed to grow very much, except for the two African countries.

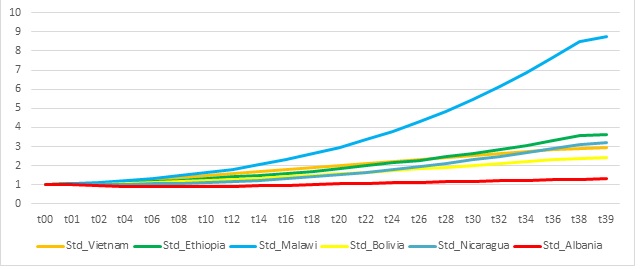

We found that income differentials across households (therefore inequality) vary substantially over time. Figure 1 shows how the standard deviation in the distribution of income, normalized to one in the base year 2011 (t00 in Figure 1), increases over time in all countries considered. Malawi stands out as the country experiencing the largest increase in income inequality.

Figure 1. An index of income inequality over time

Source: author’s elaboration. In the graphic, axis x is the projection period, from 2011 (t00) to 2050 (t39), and axis y is standard deviation in the distribution of income, normalized to 1 in t00.

Why are we observing higher income inequality? The answer from our model is quite simple. Households get income from the ownership of primary resources: capital, land, labor of different types and natural resources. Those households better off are also those who own larger shares of factors where relative returns grow more. For example, we can imagine that rich households possess large shares of capital and skilled labor. If returns on capital and skilled labor are higher than, say, land and unskilled labor, then they will get relatively richer. We also found that this phenomenon is related to the increased volume of trade.

The structural change simulated in the model has direct consequences on the distribution of income as well. For instance, as the share of services in intermediate and final consumption gets larger, and at the same time productivity in the production of services improves at a slower rate than in other sectors, the relative price of services is bound to increase (the “Solow disease”). Consequently, even the price of those primary factors for which the services are intensive (e.g. skilled labor) will follow. Income distribution would then also vary, because of the diverse ownership shares of primary factors ascribed to the various population groups.

We found that long run structural change widens income inequality in all six developing countries. Accelerated trade integration amplifies the effect further, but most of it is already generated in the baseline SSP2 scenario. A decrease in the relative value of land and an increase in the relative value of natural resources appears among the primary determinants.

We decomposed income differentials in three dimensions. Structural change worsens the income gap between male and female headed households, especially in Albania, but the additional impact of trade is minimal. The effect of structural change is not uniform across countries when income of rural households is contrasted with the one of urban households. However, more trade openness unambiguously gets income disparity larger. Finally, relative poverty generally worsens in the baseline SSP2 scenario (although absolute poverty is likely reduced), and again more trade would widen the gap.

References

Brahmbhatt, M. (1998). Measuring global economic integration: A review of the literature and recent evidence. Washington, DC: The World Bank.

Britz, W., Roson, R. (2019). G-RDEM: A GTAP-based recursive dynamic CGE model for long-term baseline generation and analysis. Journal of Global Economic Analysis, Volume 4 (1), pp. 50-96.

Britz, W., Y. Jafari, O. Nekhay, R. Roson (2020),"Modeling Trade and Income Distribution in Six Developing Countries A Dynamic General Equilibrium Analysis up to the Year 2050", Dept. of Economics Working Paper 3/2020, Ca'Foscari University, Venice.

FAO - Food and Agriculture Organization of the United Nations (2017). Small family farms data portrait. Basic information document. Methodology and data description. FAO, Rome.

Feenstra, R. C. (1998). Integration of trade and disintegration of production in the global economy. Journal of Economic Perspectives, 12(4), 31-50.

Grossman, G. M., Helpman, E. (2018). Growth, trade, and inequality. Econometrica, 86(1), 37-83.

Hsu, W. T., Riezman, R. G., Wang, P. (2019). Innovation, Growth, and Dynamic Gains from Trade (No. w26470). National Bureau of Economic Research.

Pavcnik, N. (2017). The impact of trade on inequality in developing countries (No. w23878). National Bureau of Economic Research.

Santos-Paulino, A. U. (2012). Trade, income distribution and poverty in developing countries: A survey (No. 207). United Nations Conference on Trade and Development.

Winters, L. A., McCulloch, N., McKay, A. (2004). Trade liberalization and poverty: the evidence so far. Journal of economic literature, 42(1), 72-115.

[*] Roberto Roson is Associate Professor in Economics at University of Venice Ca' Foscari. This contribution summarizes the content of a paper presented at the XXI AISSEC Conference, with the same title and co-authored with W.Britz, Y.Jafari and O.Nekhay (Britz et al., 2020).