By Andrea Coveri[*] and Antonello Zanfei[†]

The rise of global value chains (GVCs) prompted firms to increasingly specialize in specific value chain functions, the latter being conceived as the full set of business activities – from those concerning the conception of goods to the ones relating to their fabrication and commercialization – carried out to develop and bring a product to market (Feenstra, 1998; Sturgeon and Gereffi, 2009). The result has been the emergence of an ever finer international division of labour that occurs mainly at the level of individual production stages within sectors, also called “tasks” (Grossman and Rossi-Hansberg, 2008).

This transformation, together with the increasingly uneven distribution of value across actors performing different business activities, has been often associated with the “smile curve” hypothesis (Shih, 1996; Mudambi, 2008).

However, well-suited empirical analyses on the modern functional specialization of economies and tests of the predictions deriving from the smile curve are still limited in extant literature. The present work takes a step forward in this direction. By focusing on the functional specialization in terms of inward FDIs of more than 100 countries from 2003 to 2018, we provide a novel and systematic test of the “smile curve” on a global scale. Our findings shed new light on global economic asymmetries and the development prospects of emerging and developing economies in the era of GVCs. [1]

The smile curve: conceptual aspects and empirical evidence

The concept of ‘smile curve’ (Shih, 1996) has obtained a wide consideration in the GVC literature, providing a sort of “working assumption” (Baldwin and Evenett, 2015) upon which key concepts have been developed, especially the one of upgrading (Gereffi, 1999; Humphrey and Schmitz, 2002). Arguably, the reason of its success is that it seems to neatly summarize the most salient features of the modern economic reality. In fact, two relatively straightforward predictions can be derived from the smile curve hypothesis. The first prediction is that developed economies will specialize in the most intangible-intensive functions at the higher ends of the value chain, while emerging and developing regions will specialize in performing production operations. The second prediction is that a higher specialization in the most intangible-intensive stages of the value chain compared to production functions is positively related with the amount of value the economies can seize domestically from participating in GVCs.

From a theoretical point of view, the uneven distribution of value (and hence the steepness of the smile curve) is largely determined by two major drivers which insist respectively on the central part and on the higher ends of the curve (Durand and Milberg, 2020). The first driver is the high and increasing global competition among actors performing fabrication activities (Baldwin and Evenett, 2015). The second driver is the increasing role played by intangibles in GVCs and especially the strategic control that lead firms – largely based in high-income countries – maintain on functions at the higher ends of the value chain through the ownership of these peculiar assets (Chen, Los and Timmer, 2018; Jaax and Miroudot, 2021).

However, the lack of data at functional level has prevented systematic empirical tests of the smile curve. As a matter of fact, several works relied either upon case studies on GVCs of individual products (see Sturgeon et al. (2013) and UNCTAD (2015) for reviews), or on sectoral measures of trade in intermediate goods and services to detect changes in international production and value capture (e.g., Rungi and Del Prete, 2018; Meng, Ye and Wei, 2020). Yet, while case studies can hardly provide general results, sectoral measures based on input-output statistics disregard the business activities undertaken for the realization of products and services, thus failing to provide a proper test of the value distribution across GVC functions (Sturgeon and Gereffi, 2009).

An important advancement was recently provided by Timmer, Miroudot and de Vries (2019), who computed a measure of ‘functional specialization in trade’ based on the value added which can be traced back to workers employed in different functions for the production of exported goods and services. Consistently with the smile curve, they find that a positive correlation exists between the GDP per capita of economies and their specialization in R&D functions, while a negative relationship emerges between the former and the specialization of countries in fabrication activities. In a subsequent work, Buckley et al. (2020) show that in the last decades the value captured by both pre- and post-production functions has increased faster than that accruing to fabrication activities, hence providing evidence on the “deepening” of the smile curve. Finally, Stöllinger (2021) performed a cross-sectional analysis on the specialization of manufacturing industries in terms of FDIs related to different business activities and the value added to gross output ratio, finding a negative relationship between the relative specialization of industries in production activities and the latter ratio.

The work presented at the 7th OEET Workshop (2-3 December 2021), which we summarize here, takes another step forward in the empirical assessment of the smile curve at macro level by exploiting high-quality proprietary data on inward FDIs distinguished according to the GVC function they are aimed to perform. By building up a database with a remarkably broad geographical coverage (over 100 countries), our investigation aims to provide the first systematic test of the smile curve predictions on a global scale.

Empirical strategy: a two-step procedure

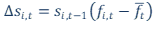

In this work we use data on inward FDIs to proxy the specialization of the economies across value chain functions. To this aim, we exploit the fDi Markets database, i.e., an online database provided by fDi Intelligence that collects detailed information on announced cross-border greenfield investments covering all sectors and countries worldwide from 2003 onwards. A distinctive feature of fDi Markets consists in reporting the value chain function – e.g., R&D, design and development, manufacturing, sales, marketing and support, etc. – each FDI project is aimed to perform. This is the key information we use to compute our indicator of functional specialization of the economies, which is found by computing the Balassa’s (1965) index of revealed comparative advantage based on inward FDIs in different value adding functions. We call this ‘functional specialization in FDI’ (FS). This indicator is therefore an inward FDI-based specialization index which captures for the i-th country in a given year the relative attractiveness of investments in the a-th value chain function. In formal terms, it is calculated as follows:

where the share of inward FDIs related to a given function over total inward FDIs received by a given economy (the numerator) is normalized according to the share of inward FDIs in the same function over total inward FDIs for the world as a whole, namely the global average (the denominator).

Our empirical strategy unfolds in two steps. The first step consists in measuring the functional specialization of economies in terms of FDIs and assess whether the resulting functional division of labour at global scale reflects the one predicted by the smile curve. This complements previous research based on functional specialization based on trade data and provides novel evidence on patterns of captive offshoring of world areas according to their degree of development. In addition, we pay attention to the dynamic dimension and illustrate the evolution of functional specialization in FDI of world macro-areas over time. The second step consists in investigating the links between the functional specialization of the economies and their capability to capture value in GVCs.

Results of the first step

The first step of our empirical analysis is aimed to test the first prediction of the smile curve, namely the one concerning the international division of labour. To this scope, we investigate the relationship between the FDI-based specialization of countries across GVC functions and their development level (proxied by GDP per capita). The functions we focus on are the following: Headquarters (HQ), Research and Development (R&D), Design, Development and Testing (DDT), Manufacturing (Man), Logistics, Distribution and Transportation (LDT), and Sales, Marketing and Support (SMS). A battery of panel between-effects model at country-year level are estimated for this purpose.

Our results largely confirm the “prediction” of the smile curve with regards to the functions most performed by countries at different stages of development. In particular, we find the highest positive and significant coefficients for GDP per capita when the dependent variable is the inward FDI-based specialization in the most upstream functions, i.e., HQ and R&D. Moving to the right along the smile curve, the coefficient of GDP per capita initially remains positive and significant but decreases its magnitude, and turns negative when the dependent variable is the specialization of economies in drawing FDIs in manufacturing functions. Finally, GDP per capita again report positive and significant coefficients when the dependent variables are the functional specialization of countries in LDT and SMS functions respectively, with the magnitude of the former coefficient being slightly lower than the latter.

Moreover, we provide an overview on the evolution of the functional specialization of macro-regions by computing on a year-per-year basis our indicator of functional specialization for the whole group of advanced economies, the whole group of developing economies, as well as for China and India alone. To this aim, we classify value adding functions in the three canonical stages of the value chain, i.e., the upstream, production and downstream segment (Mudambi, 2008; Baldwin and Evenett, 2015) and compute the functional specialization in FDI of macro-regions across these three GVC stages.

Our findings show that advanced countries have proceeded to de-specialize in production activities, with an acceleration in the years of deep crisis. This pattern corresponds quite symmetrically to a higher involvement of low-income world areas as fabrication hubs. Even in the case of the most dynamic emerging countries in Asia, i.e., China and India, what is remarkably increasing is only the specialization in production operations. In particular, China confirms and consolidates its profile as the largest attractor of FDIs in production; nonetheless, since 2006 this country also reports a value of the specialization index in upstream functions which fluctuates around one. In the midst of the great financial crisis, India appears to have significantly reduced its once remarkable capability to attract FDIs in upstream activities, although in 2018 this country still reports a specialization in these high value-added functions greater than in production ones.

Results of the second step

The second step of our empirical investigation is aimed to test the second prediction stemming from the smile curve hypothesis, namely that higher specialization of countries in most intangible-intensive segments of the value chain is associated with higher value capture in GVCs.

We estimate a fixed-effects model – which also includes a number of control variables on the level of economic development, technology, industrial structure, quality of institutions and GVC participation and position of the economies – on a balanced panel dataset of 102 countries over the period 2003-2018. The dependent variable in our model is the domestic value added embodied in exports (DVA) per capita (data on DVA are drawn by the UNCTAD-Eora GVC Database; see Casella et al., 2019). This indicator provides a measure of the gains that a country captures domestically from trade in a GVC context, as it computes the value added captured by domestic actors participating to the country’s export chains.[2] As data on the domestic value-added content of exports are available for a wide range of developed and developing countries, this indicator perfectly fits our objective of studying value capture in GVCs in a truly global perspective. Our key regressor is what we call the Relative Functional Specialization (RFS) index, namely a country-year level indicator computed as the functional specialization of the economies in production functions over the sum of their functional specialization in both upstream and downstream stages of the value chain.

Our estimate results can be summarized as follows. First, all estimates show a negative and statistically significant coefficient of the RFS index, confirming that a higher specialization in production compared to upstream and downstream functions is associated to a lower amount of value captured domestically in export chains. Notably, the total number of FDIs always reports a negative and significant coefficient, revealing that it is not inward FDIs per se, i.e., regardless of their composition, that increases value capture capabilities.

Second, when we control for structural characteristics of countries, including inter alia lagged measures of the forward and backward GVC participation of economies, as well as proxies of their GVC position based on the ratio between these indicators, our main findings are largely confirmed.

Conclusions

The global unbundling of production and the subsequent “slicing up” of value chains across countries have given rise to a finer international division of labour which increasingly occurs at the level of individual value-adding functions (Sturgeon, 2008; Sturgeon and Gereffi, 2009; Timmer et al., 2014). A major driver of this process has been the massive growth of cross-border investment flows, which has contributed to the growing involvement of low- and middle-income countries in GVCs. In this context, the ‘smile curve’ has gained increasing attention as a sort of stylized fact able to summarize the most salient features of the modern international division of labour and the associated distribution of value along GVCs.

However, evidence provided by previous research on the smile curve is largely scattered and empirical analyses on the association between the functional specialization of economies and value capture in GVCs are still limited in extant literature. To fill this gap, in this work we provided the first systematic empirical assessment on a global scale of the main predictions deriving from the smile curve hypothesis by focusing on the functional specialization in FDIs for a large sample of world economies.

Three main findings emerge from our empirical investigation. First, as predicted by the smile curve, the most upstream and downstream value chain functions are mainly performed by the most developed countries, while production operations at the lower end of the value chain are mainly the prerogative of less developed world macro-regions. Second, the observed specialization patterns largely consolidated over the period under investigation. Third, and consistently with the predictions deriving from the smile curve, higher specialization in the intangible-intensive segments of the value chain is associated with greater value capture in GVCs.

In this scenario, fast-growing emerging countries such as China and India seem to represent more of an exception than a rule and the (heretic) developmental policies they have put in place should gather major attention.

References

Balassa, B. (1965) Trade Liberalisation and “Revealed” Comparative Advantage. The Manchester School, 33(2): 99–123.

Baldwin, R. E., Evenett, S. J. (2015) Value creation and trade in 21st century manufacturing. Journal of Regional Science, 55: 31-50.

Buckley, P.J., Strange, R., Timmer, M.P., de Vries, G.J. (2020) Catching-up in the global factory: Analysis and policy implications. Journal of International Business Policy, 3: 79–106.

Casella, B., Bolwijn, R., Moran, D., Kanemoto, K. (2019) Improving the analysis of global value chains: the UNCTAD-Eora Database. 2019. Transnational Corporations, 26(3): 115-142.

Chen, W., Los, B., & Timmer, M.P. (2018). Factor incomes in global value chains: The role of intangibles. NBER Working Paper, No. 25242.

Durand, C., Milberg, W. (2020) Intellectual monopoly in global value chains. Review of International Political Economy, 27(2): 404–429.

Feenstra, R.C. (1998) Integration of trade and disintegration of production in the global economy. Journal of Economic Perspectives, 12: 31–50.

Gereffi, G. (1999) International trade and industrial upgrading in the apparel commodity chain. Journal of International Economics, 48(1): 37–70.

Grossman, G.M., Rossi-Hansberg, E. (2008) Trading tasks: a simple theory of offshoring. American Economic Review, 98: 1978–1997.

Humphrey, J., Schmitz, H. (2002). How does insertion in global value chains affect upgrading in industrial clusters? Regional Studies, 36(9): 1017–1028.

Jaax, A., Miroudot, S. (2021) Capturing value in GVCs through intangible assets: The role of the trade–investment–intellectual property nexus. Journal of International Business Policy. DOI: 10.1057/s42214-020-00086-2

Meng, B., Ye, M., Wei, S.-J. (2020) Measuring Smile Curves in Global Value Chains. Oxford Bulletin of Economics and Statistics, 82(5): 988-1016.

Mudambi, R. (2008) Location, control and innovation in knowledge-intensive industries. Journal of Economic Geography, 8: 699-725.

Rungi, A., Del Prete, D. (2018) The smile curve at the firm level: Where value is added along supply chains. Economics Letters, 164: 38–42.

Shih, S. (1996). Me-too is not my style: Challenge difficulties, break through bottlenecks, create values. Taipei: The Acer Foundation.

Stöllinger, R. (2021) Testing the Smile Curve: Functional Specialisation and Value Creation in GVCs. Structural Change and Economic Dynamics, 56: 93-116.

Sturgeon, T. (2008) Mapping integrative trade: conceptualising and measuring global value chains. International Journal of Technological Learning, Innovation and Development, 1:237–257.

Sturgeon, T., Gereffi, G. (2009) Measuring success in the global economy: international trade, industrial upgrading, and business function outsourcing in global value chains. Transnational Corporations, 18: 1–35.

Sturgeon, T., Nielsen, P.B., Linden, G., Gereffi, G., Brown, C. (2013) Direct measurement of global value chains: collecting product- and firm-level statistics on value added and business function outsourcing and offshoring. In Mattoo, A., Wang, Z., Wei, S.-J. (eds) Trade in value added: developing new measures of cross-border trade. Washington, DC: The World Bank, pp. 289–319.

Timmer, M.P., Erumban, A.A., Los, B., Stehrer, R., de Vries, G.J. (2014) Slicing up global value chains. Journal of Economic Perspectives, 28: 99–118.

Timmer, M.P., Miroudot, S., de Vries, G.J. (2019) Functional specialisation in trade. Journal of Economic Geography, 19(1): 1–30.

UNCTAD (2015) Tracing the value added in global value chains: product-level case studies in China. United Nations.

[*] Department of Economics, Society, and Politics, University of Urbino ‘Carlo Bo’; E-mail:

[†] Department of Economics, Society, and Politics, University of Urbino ‘Carlo Bo’; E-mail:

[1] This contribution summarizes the conceptual framework adopted and the main findings of a research contribution presented at the 7th OEET Workshop (2-3 December, Collegio Carlo Alberto, Turin).

[2] However, no guarantees exist that gross profits are retained domestically. In fact, the capital income seized by local affiliates of MNCs headquartered abroad can be easily moved away from the local economy and transferred to the residence of MNCs’ shareholders. It follows that the asymmetries in the distribution of value along GVCs are likely to be even more unequal than what may appear from our investigation.